May 8, 2017

[caption id="attachment_1382" align="aligncenter"

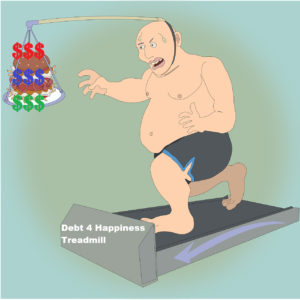

width="300"] Debt for Happiness[/caption]

Debt for Happiness[/caption]

We never learn me included, I was financially obese and in debt.

the original post Are you financially fat or Obese?2009 was my financial wake-up call. I was laid off from my job because our economy went to shit in a hand basket. Like many Americans, there was a shift in consciousness concerning ideology concerning the American dream and living. Once you begin to lose "things" "Thought" of as important and find how important they are not.

I like many other fellow citizens were living way beyond our income level. Funny thing, I kept asking myself before the 2008 crash, how long could real estate prices continue to rise, and banks keep making refinance loans greater than 100 of collateral. Still, my logic did not deter me from spending five hundred to a thousand dollars more than I was making at my day job.

Here are the bills I was paying frequently costing me $5k a month.

- 1st mortgage

- Second mortgage

- Discover card (several thousand dollar balance)

- Very high balance revolving open credit line.

- Visa #1

- Master card #1

- Visa #2

- Car payment number 1

- Car payment number 2

- Cable bill

- Separate internet bill

- Daughter's Harp rental(yes full size)

- Mbna credit card

- Car insurance for three cars (two drivers in household)

- Misc bills I can't remember.

Mission Statement

I will not have more debt than I can pay off at any given moment of my choosing. There is one exception I had to make, which is housing. For several years I was an apartment dweller until I remarried. The apartment allowed me to control my living expenses for about 5 years. The good news is, because I worked on living for need versus want, I was able to repair my credit, savings, and peace of mind. When I did purchase a new home i received the best interest rate. My interest rate made me gasp, as it was the lowest I've ever experienced. [youtube https://www.youtube.com/watch?v=vJfHD7DPl9U]What I learned.

Even though everyone and common wisdom may inform us to save your money, the financial temptation is EVERYWHERE! Don't be good rich! rich is looking like you have everything under control materially but owning nothing of value. Being Rich is looking like you have everything under control materially but owning nothing of value. Don't be surprised, doctor, lawyers people who you think have the resources are suffering too. It's all about outside perceptions. Just because someone earns $250,000 annually does not provide financial security, if someone is financially overextended.Money is the new crack!

Companies make it easy to take your money in order for us to look wealthy but be functionality poor. Banks make us functional addicts by issuing credit, and the lessons learned by many in 2008 are starting g to be forgotten. Not me! Live for need and make "wants" rewards for good behavior. I know now, a second reprogramming was required. After paying off my debts and living below my means, what's next. The answer, more of the same. Don't spend it just because you have it to spend.Here is how it's done.

- Your phone works find you don't need a new one.

- Your TV still has sound and picture you don't need a 70 inch OLED because it's new.

- Yep, your car is old but it cheaper to fix it than to buy a new one.

- Make your much it's healthier than buying processed fast food.

- Use your library, you would be amazed at how much it saves you.

- Chose to purchase experiences versus things.

- Get a bank account not easily accessible and direct deposit minimal 10% of your income.

- Learn something new to generate an income. (Try to make(profit) $100) a month and save that money.

Think of it this way.

- Do you have a safe home?

- Do you have enough food?

- Are you healthy?

- Are you loved?

- Do you have clothes to wear?